IE TC1 free printable template

Show details

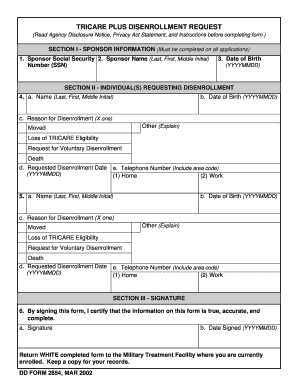

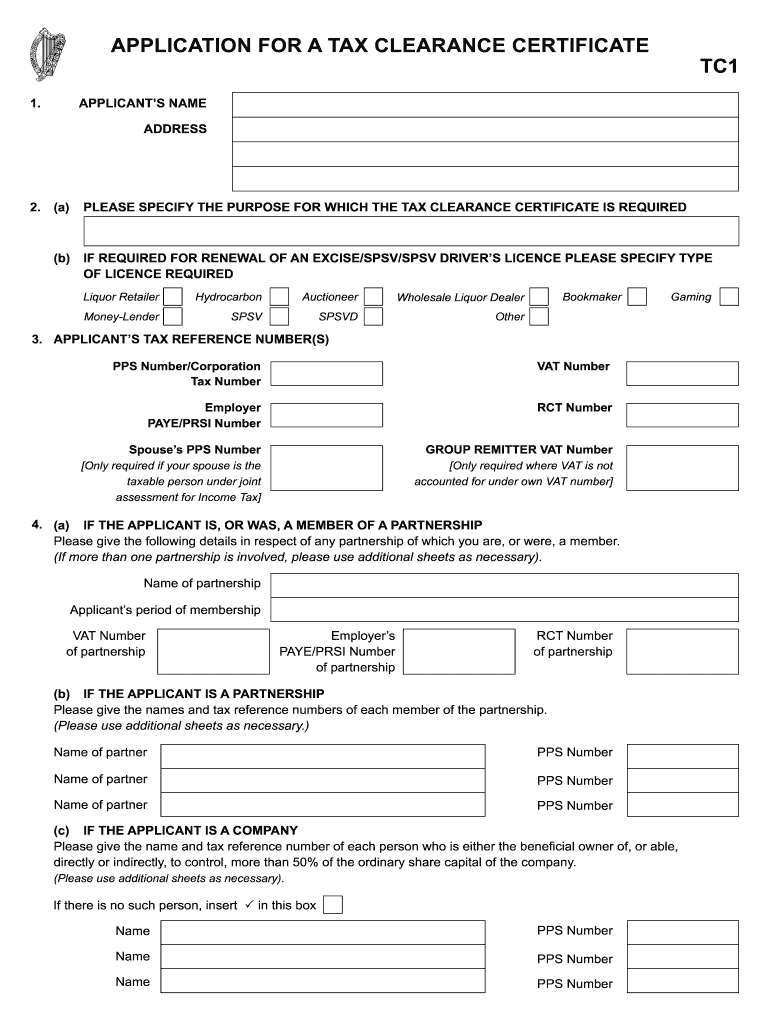

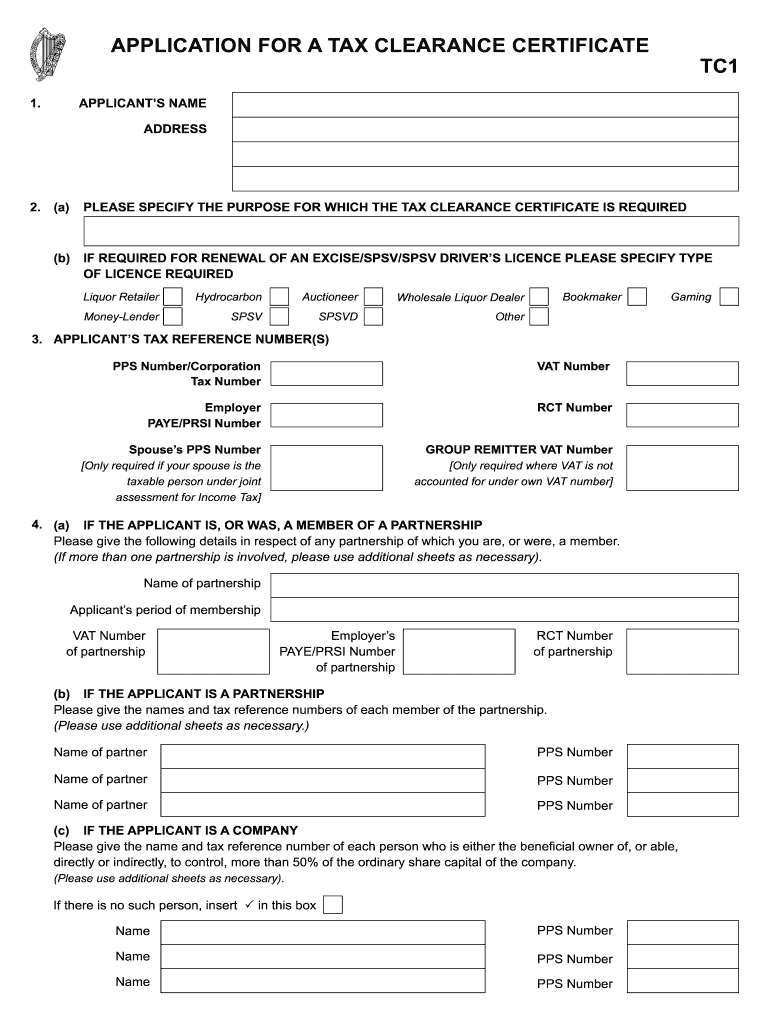

APPLICATION FOR A TAX CLEARANCE CERTIFICATE 1. TC1 APPLICANT S NAME ADDRESS 2. (a) PLEASE SPECIFY THE PURPOSE FOR WHICH THE TAX CLEARANCE CERTIFICATE IS REQUIRED (b) IF REQUIRED FOR RENEWAL OF AN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tc1 form

Edit your revenue form tc1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax tc1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ie application tax clearance certificate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tc1 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ireland application tax clearance form

How to fill out IE TC1

01

Obtain the IE TC1 form from the relevant tax authority's website or office.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Enter your personal details, including your name, address, and tax identification number.

04

Provide information on your total income for the relevant tax year.

05

List any deductions or allowances you are claiming.

06

Calculate your tax owed based on the information provided.

07

Review the completed form for accuracy before submission.

08

Submit the form through the designated method, whether online or by mail.

Who needs IE TC1?

01

Individuals who are required to report their income for tax purposes.

02

Self-employed persons who need to declare their earnings.

03

Businesses that have to report their revenues and expenses.

04

Tax residents who wish to claim deductions or tax credits.

Fill

tc1 application for a tax clearance certificate

: Try Risk Free

People Also Ask about tc1 application

How do I get a tax clearance certificate Ireland?

To obtain a tax clearance certificate, you will need to put your tax affairs in order by dealing with the outstanding issues. You will also need to ensure that any outstanding issues are addressed in the tax affairs of any connected parties.

What is an Irish tax clearance certificate?

A Tax Clearance Certificate is confirmation from Revenue that an applicant's tax affairs are in order. Revenue may issue a Tax Clearance Certificate to a customer who has tax arrears where the arrears are covered by an instalment arrangement.

What is a clearance certificate?

A clearance certificate will allow you, as the legal representative, to distribute assets without the risk of being personally responsible for unpaid amounts the person who died, estate, trust, or corporation might owe to the CRA. Your financial institution or lawyers may also ask you for a clearance certificate.

How long does it take to get a tax clearance certificate Ireland?

Once you correctly complete the form, it normally takes about six weeks to get your TCC. Remember you may need to renew the TCC each year.

How long is a tax clearance certificate valid Ireland?

Your Tax Clearance Certificate remains valid while you are compliant. This means that there is no need for an end date on the certificate. You will need to submit a new application for a Tax Clearance Certificate when your application has expired. A grant application expires after one year.

How do I get an Irish tax clearance certificate?

You can apply for a Tax Clearance Certificate online using the electronic Tax Clearance (eTC) system. You apply online using myAccount if you are a Pay As You Earn (PAYE) customer. Business customers apply using Revenue Online Service (ROS). Read more about how to apply for a Tax Clearance Certificate online.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ireland tc1 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including tc1 application form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in form tc1?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your tc1 tax clearance certificate to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out ireland tc1 online on an Android device?

Use the pdfFiller mobile app and complete your tc1 application tax pdf and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is IE TC1?

IE TC1 is a customs declaration form used in Ireland for the importation of goods and for customs compliance.

Who is required to file IE TC1?

Individuals or businesses importing goods into Ireland from outside the EU are required to file IE TC1.

How to fill out IE TC1?

To fill out IE TC1, accurately provide information such as the importer's details, a description of the goods, their value, and any applicable tariff codes.

What is the purpose of IE TC1?

The purpose of IE TC1 is to ensure compliance with customs regulations and to assess duties and taxes on imported goods.

What information must be reported on IE TC1?

Information that must be reported includes the importer's name and address, the description of the goods, their classification code, value, and any applicable duty and VAT.

Fill out your IE TC1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ireland Application Tax Clearance Certificate is not the form you're looking for?Search for another form here.

Keywords relevant to pdffiller com

Related to tc1 application tax clearance certificate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.